Kyle Langston

I am Kyle Langston, a finance expert at Money6x.blog, specializing in investing, wealth management, and financial trends. I simplify complex money topics to help readers make smarter financial decisions.

Subscribe To Newsletter

MONEY6x.com – Smart Ways to Multiply 6x Your Money

Money doesn’t grow on trees, but it can grow if you know where to plant it. Many people chase wealth but never quite catch it. MONEY6x.com claims to show ways to multiply your money six times over. Let’s see if it’s worth your time.

What is MONEY6x.com?

MONEY6x.com teaches how to grow wealth through smart investments. It provides tools, analysis, and strategies that have worked for others.

Most people either play it too safe or take reckless risks. The key is to find that sweet spot—bold but not blind.

The Idea Behind MONEY6x .com

Traditional savings barely keep up with inflation. To build real wealth, you need investments that outpace it. MONEY6x.com highlights strategies that aim to do just that.

I’ve seen people sit on piles of cash, terrified of losing it. Meanwhile, others jump into investments they don’t understand. Success happens somewhere in between—smart moves backed by solid knowledge.

Fashion and investing both have trends—some fade quickly, while others last. Like the wolf cut, which mixes modern style with a classic touch, smart investments combine new opportunities with stable choices. MONEY6x.com helps you find the right balance, making your financial future both stylish and secure.

How MONEY6x.com Helps You Multiply Your Money?

The site breaks wealth-building into clear, actionable steps. No vague theories—just real strategies that work if applied correctly.

Investment Tools and Resources

- Learning Materials: Easy-to-understand guides on stocks, crypto, real estate, and more.

- Profit Calculators: Helps estimate potential returns before investing.

- Market Updates: Keeps you informed on financial trends.

- Expert Insights: Advice from seasoned investors who’ve been through the ups and downs.

- Step-by-Step Plans: Actionable blueprints for different investment strategies.

- Risk Management Advice: Helps you avoid common pitfalls and minimize losses.

Reading is useful, but action matters more. Many wait for the “perfect moment” and never start. That’s a guaranteed way to stay stuck.

Proven Strategies to 6x Your Money

There’s no magic formula, but these methods have helped many grow their wealth.

1. Stock Market Investments

The stock market isn’t just for Wall Street pros. A well-picked stock can double or triple in value over time.

I once bought shares in a company that nobody cared about. Three years later, it had skyrocketed. It wasn’t luck—I did the research and trusted the process.

Tip: Time in the market beats timing the market. Buy smart, hold steady.

Additional Consideration: Instead of chasing “hot stocks,” focus on companies with solid long-term potential. A flashy pick today can be a financial regret tomorrow.

2. Real Estate

Owning property is like planting a money tree—it grows over time and pays dividends.

Some of the best deals happen when others are too scared to buy. If you can spot a rising market, you’ll be ahead of the game.

Tip: Look for areas where prices are climbing, not where they’ve already peaked.

Rental Income Potential: Real estate isn’t just about flipping properties. Long-term rentals create a steady cash flow, turning your investment into an ongoing income stream.

3. Cryptocurrency

Crypto is a wild ride, but the right moves can yield massive returns.

A friend of mine made 10x returns by investing early. Another lost half his savings by chasing hype. Lesson? Research first, invest second.

Tip: Never put in money you can’t afford to leave untouched for years.

Diversify: Instead of throwing everything into one coin, spread investments across multiple promising projects. This reduces risk while keeping the upside potential.

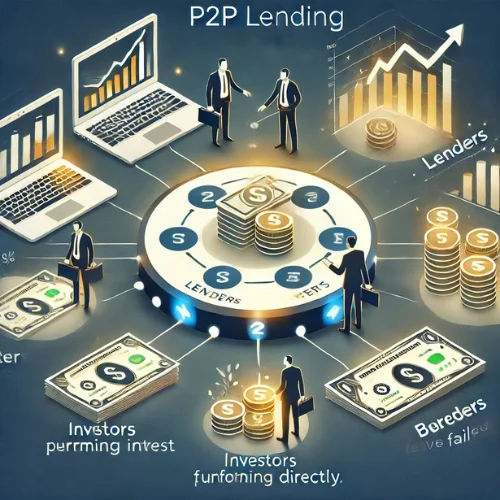

4. Peer-to-Peer Lending

P2P lending lets you earn interest by funding loans directly.

I’ve tested this. Some loans paid well; others flopped. Diversifying saved me from major losses.

Tip: Spread your money across multiple loans to reduce risk.

Understand Default Risks: While the interest rates may look tempting, some borrowers may default. Choose platforms with solid vetting processes to minimize bad loans.

5. High-Yield Savings and CDs

Not flashy, but solid. These accounts offer safe returns with minimal risk.

Tip: Use them for emergency funds or short-term financial goals.

Locking in Rates: CDs often provide better interest rates if you’re willing to leave your money untouched for a fixed period. Consider mixing short-term and long-term CDs for better flexibility.

6. Digital Entertainment & Streaming Investments

The entertainment industry is booming, with streaming services seeing massive growth. Investing in media platforms is one way to multiply wealth. Apps like Freecine allow users to access premium content, highlighting the increasing demand for digital entertainment. As more people shift to online streaming, businesses and investors alike are tapping into this lucrative market.

Pros and Cons of MONEY6x.com

Pros

- Clear investment strategies: Easy to follow, no jargon.

- Multiple approaches: Stocks, crypto, real estate—something for everyone.

- Useful tools: Calculators and trend analysis simplify decision-making.

- Regular updates: Keeps you ahead of market shifts.

- Expert insights: Learn from real investors, not just theory.

- Diverse content: Suitable for both beginners and experienced investors.

Cons

- No guarantees: Investing always carries risk.

- Overwhelming for beginners: A lot of information to digest.

- Market-dependent: Some strategies thrive in certain conditions but struggle in others.

- Not a quick fix: Requires time, effort, and patience.

- Needs startup capital: Some options require money to make money.

Understanding the Risks

Every investment has risks. Knowing them helps you avoid costly mistakes.

1. Market Swings

Stock prices and crypto values can drop overnight. If you panic and sell, you lock in losses.

I’ve seen people sell at the bottom, then regret it when prices rebounded. Emotional investing is a wealth killer.

2. Scams and Overpromises

If something sounds too good to be true, it usually is. Research everything before investing.

3. Liquidity Issues

Real estate and P2P lending tie up money. You can’t cash out instantly.

A property might look great on paper, but if you need money fast, selling isn’t instant.

4. Over-Leveraging

Taking on too much debt to invest can backfire. A market dip could wipe out gains and leave you owing money.

Frequently Asked Questions

Is it realistic to 6x my money?

Yes, but not overnight. It takes smart moves, patience, and calculated risks.

What’s the safest way to grow my money?

Diversify. Stocks, real estate, and savings accounts balance risk and reward.

How do I start investing?

Educate yourself, set goals, and begin small. The worst move is doing nothing.

Some of the best investors I know started with tiny amounts. Their biggest regret? Not starting sooner.

Can I lose money?

Absolutely. Every investment carries risk. Managing that risk is the key to long-term success.

How do I know which strategy is right for me?

Consider your financial goals, risk tolerance, and timeline. There’s no one-size-fits-all approach.

Conclusion

Multiplying your money is possible, but it requires action, strategy, and patience. MONEY6x.com offers tools and knowledge to help, but no one will do the work for you.

Wealth doesn’t come to those who wait—it comes to those who move. The real question is, will you?